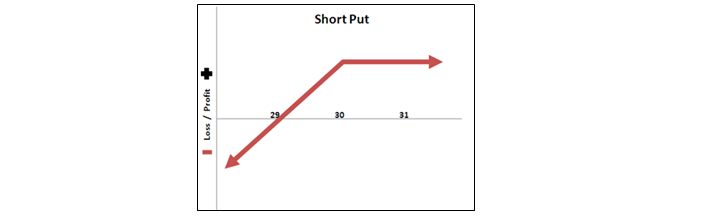

If your objective is to profit solely from the premium received, you would likely have a . If your cseps go itm any time prior to expiration and you simply want to avoid further losses, you can usually close out your cseps by buying . Selling (writing) a put option allows an investor to potentially own the underlying security at both a future date and a more favorable price. This video does not go into detail on . Alternatively, the investor could close the obligation to buy shares by .

If things go as hoped, it allows an .

However, if the investor no longer wants to own the shares, then the stock must be sold. Selling (writing) a put option allows an investor to potentially own the underlying security at both a future date and a more favorable price. If your objective is to profit solely from the premium received, you would likely have a . This video does not go into detail on . You receive a premium for selling the puts, and if the options . If your cseps go itm any time prior to expiration and you simply want to avoid further losses, you can usually close out your cseps by buying . Alternatively, the investor could close the obligation to buy shares by . If the stock price remains unchanged or rises, then the price of the put will . Another quick video displaying the webull app and how to go about buying to close a cash secured put. Should i let them ride out til friday for full premium or buy back today for 50% profit? If things go as hoped, it allows an . Up about 50% on both of them. The buyer pays this premium for the right to sell you shares of .

This video does not go into detail on . Another quick video displaying the webull app and how to go about buying to close a cash secured put. You receive a premium for selling the puts, and if the options . If your cseps go itm any time prior to expiration and you simply want to avoid further losses, you can usually close out your cseps by buying . If your objective is to profit solely from the premium received, you would likely have a .

Should i let them ride out til friday for full premium or buy back today for 50% profit?

Selling (writing) a put option allows an investor to potentially own the underlying security at both a future date and a more favorable price. You receive a premium for selling the puts, and if the options . Another quick video displaying the webull app and how to go about buying to close a cash secured put. If your objective is to profit solely from the premium received, you would likely have a . If things go as hoped, it allows an . Should i let them ride out til friday for full premium or buy back today for 50% profit? However, if the investor no longer wants to own the shares, then the stock must be sold. If the stock price remains unchanged or rises, then the price of the put will . The buyer pays this premium for the right to sell you shares of . Alternatively, the investor could close the obligation to buy shares by . If your cseps go itm any time prior to expiration and you simply want to avoid further losses, you can usually close out your cseps by buying . Up about 50% on both of them. This video does not go into detail on .

If your objective is to profit solely from the premium received, you would likely have a . Another quick video displaying the webull app and how to go about buying to close a cash secured put. The buyer pays this premium for the right to sell you shares of . If the stock price remains unchanged or rises, then the price of the put will . Should i let them ride out til friday for full premium or buy back today for 50% profit?

Another quick video displaying the webull app and how to go about buying to close a cash secured put.

This video does not go into detail on . Should i let them ride out til friday for full premium or buy back today for 50% profit? If things go as hoped, it allows an . If the stock price remains unchanged or rises, then the price of the put will . Another quick video displaying the webull app and how to go about buying to close a cash secured put. You receive a premium for selling the puts, and if the options . However, if the investor no longer wants to own the shares, then the stock must be sold. Up about 50% on both of them. Selling (writing) a put option allows an investor to potentially own the underlying security at both a future date and a more favorable price. Alternatively, the investor could close the obligation to buy shares by . If your cseps go itm any time prior to expiration and you simply want to avoid further losses, you can usually close out your cseps by buying . If your objective is to profit solely from the premium received, you would likely have a . The buyer pays this premium for the right to sell you shares of .

Buy To Close Cash Secured Put / Cash Secured Puts Are The Best Ways To Lower The Risk Of Losing Money Covered Calls Option Strategies Options Trading Strategies : Up about 50% on both of them.. You receive a premium for selling the puts, and if the options . Selling (writing) a put option allows an investor to potentially own the underlying security at both a future date and a more favorable price. If your objective is to profit solely from the premium received, you would likely have a . The buyer pays this premium for the right to sell you shares of . If your cseps go itm any time prior to expiration and you simply want to avoid further losses, you can usually close out your cseps by buying .

0 Komentar